The Banking Crisis Enters Stage II

The banking crisis is NOT over, it has shifted into second gear. Many regional banks now face existential crises driven by the spillover from coordinated bank runs at SVB/Signature. Time for bank executives, boards, and counsel is running out to prevent bankruptcy and/or FDIC fire-sale.

Bank Risk Monitor can help you

navigate through this mess.

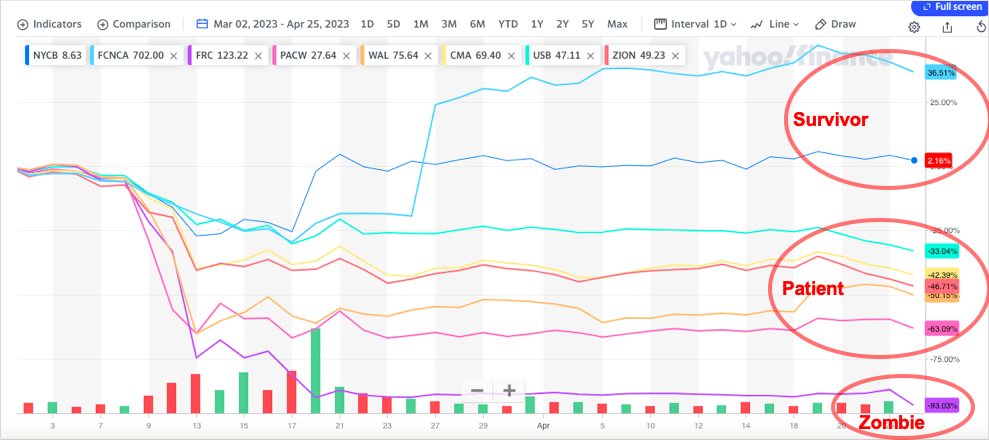

Selected regional bank stock prices show the effect of the contagion post-SVB. Equity investors are categorizing banks into "good" and "bad". Those that buy fire-sale assets (FCNCA and NYCB) will be rewarded while others are punished. For most regional banks now, the game is to avoid the lowest "bad" rating of "zombie" (FRC).

It is a very difficult time to be running a bank.

In Senate testimony, the Fed claimed Silicon Valley Bank failed because:

Management failed to appropriately address clear interest rate risk;

Management failed to appropriately address clear liquidity risk;

Management missteps in uninsured deposits; and

Management missteps in heavy losses on securities portfolios.

*If this terminology is foreign to you, don't despair, Bank Risk Monitor can explain and help you distinguish your bank from others.

Now, wait a minute! ALL banks face these issues. Is your bank immune to similar criticism? The banking industry has an asymmetric information ("lemons") problem right now.*

The most direct way to solve a lemons problem is through independent verification.

Bank Risk Monitor provides

independent and defensible expert opinions on your bank's risk management.

Built on decades of experience navigating banking risk management

Every bank is unique. Your approach to manage interest rate, liquidity, and valuation risks should be assessed in the context of your business.

Dr. Andrew B. Miller

Expert in valuation and risk management for banks

For over 25 years Dr. Miller has provided advisory and expert services to banks just like yours. His expert opinions are completely independent, defensible in court (and to your Board of Directors), and are communicated in understandable language. Yes, he is a financial rocket scientist and yes, he can explain it to your grandmother.

Contact Dr. Miller to find out how his expertise can help your bank navigate the current environment.

- Founder and CEO, Bank Risk Monitor

- Chief Investment Officer, WellFinance, Fixed Income and Derivatives

- Professor, NYU, Economics - Math

- Managing Director, Chicago Partners, NYC

- PricewaterhouseCoopers

- PhD Cornell, Economics

- MS Stanford, Financial Engineering

- BS UCSB, Applied Math